Lennox International (LII) is a global firm specializing in the design, manufacturing, marketing, and selling of products across the HVAC and refrigeration verticals. The company primarily focuses its operations in the United States and derives revenue from a variety of sources including installation and service of HVAC equipment, retailing its products through Lennox PartsPlus, securing contracts with commercial clients, and leveraging relationships with food retail and cold storage companies for its refrigeration unit. Though the HVAC market is dominated by large manufacturers at the beginning of the product life cycle, it is fragmented across tens of thousands of small contractors when these parts need to be installed and maintained. Lennox is unique in that it not only designs and manufactures these units but also markets them through hundreds of retail locations and also physically installs and maintains the units themselves in many locations. The growing business segments for Lennox have driven incremental growth year after year, pushing Lennox to one of the largest global HVAC companies poised to continue strong into the future.

Residential Business with Strong Historical Performance

Despite being an international HVAC and refrigeration company, an overwhelming 93% of revenues come from North America, largely from the United States. However, the company's revenue segments across the residential and commercial segments protect the company from cyclicality and have produced steady gains year after year.

Lennox International - 2018 William Blair Growth Stock Conference

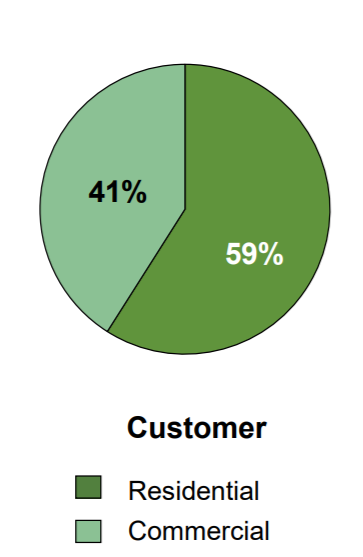

Lennox is still majority residential services which does expose it to consumer spending behavior and the housing market. Consumer demand for HVAC units and services as well as new technology including smart thermostats developed by Lennox will ultimately be a major driving force behind growth in the residential business segment. However, what's important is that while Lennox is almost 60% residential, nearly 3/4 of their business across both the commercial and residential segments are focused on maintenance and service, not initial construction. As a result, the residential business segment has seen relatively slow but consistent and stable growth in the past several years.

In the residential segment, revenues between 2013 and 2017 modestly grew from $3.2 billion to $3.8 billion with $3.9 billion expected for 2018. In the historical timespan, there isn't a single year when revenue fell. Along with this, GAAP EPS grew from $3.55 in 2013 to $7.17 in 2017 with full-year 2018 EPS estimates of $8.79-9.39. Free cash flow has increased from $134 million to $395 million. So revenue is growing slowly, but Lennox is driving the bottom line to some seriously impressive margin improvements. But what about that cyclicality? What if we go back further to analyze the historical price trends?

LII data by YCharts

LII data by YCharts

With Lennox historically being heavily concentrated in the residential segment, you would think that the housing market crash and decline in consumer confidence and spending would wreak havoc on Lennox. The stock declined a mere 5% over the course of the recession, and it's largely to do with Lennox's residential business segment being concentrated in the sale of residential HVAC units to contractors as well as an emphasis on recurring revenue from preventative maintenance and service. Because of the structure of Lennox's revenue model, they were largely insulated from the economic pressures around them.

Commercial Success With Variety of Contracts

Though the residential segment makes up a larger percentage of revenues for Lennox, the commercial segment has also performed well over the past several years. Its success can be attributed to the reason for the residential segment's consistent performance: diversification of revenue sources.

Lennox derives part of its commercial revenue from straight commercial sales to other commercial HVAC companies in the B2B market. However, a larger percentage of the sales in the commercial segment come from national accounts with large corporations, sale of individual parts to local contractors, and HVAC projects for different verticals. Lennox's national account services provide its HVAC equipment, installation & service, and customer support. Some of its customers include distribution centers, large hospitals, and national department stores.

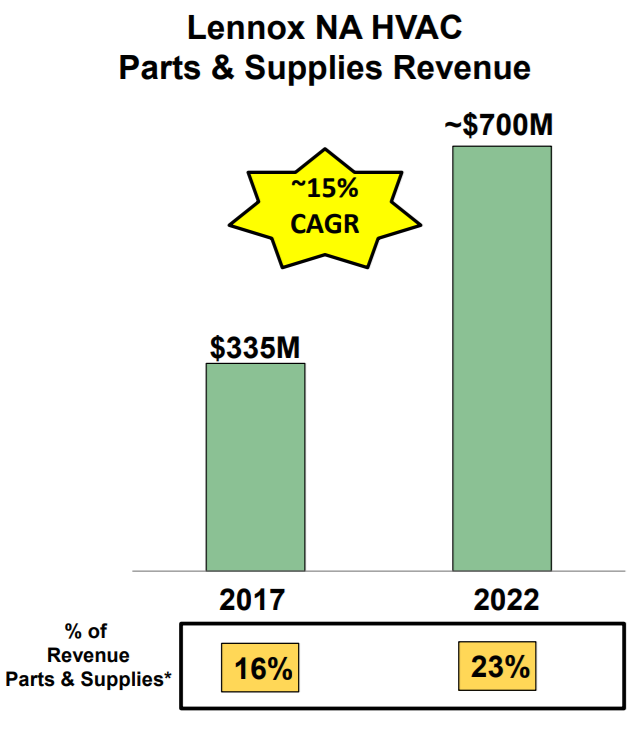

Along with this, Lennox also serves to the commercial market in its Lennox PartsPlus stores. Sales to local contractors across the country puts Lennox equipment into the hands of thousands of small businesses.

Lennox International - 2018 William Blair Growth Stock Conference

The stores, through both residential sales, and more importantly, commercial sales, have provided an outlet for Lennox to gain traction in the retail segment boosted by same stores sale growth and a strategy to get its products used by contractors nationwide.

The third revenue source for Lennox includes contracts with local businesses including manufacturing firms, schools, and small-rise office buildings. Total commercial heating and cooling revenue rose from $918 million to $974 million from 2016 to 2017 and service revenue from $133 million to an estimated $190 million by 2020. With an increasing number of contracts being won with both local and national companies, service revenue will likely meet or exceed these estimates.

A Differentiated Refrigeration Strategy

Similar to how HVAC can be performed by tens of thousands of small businesses across the country, so can refrigeration services. Lennox has leveraged its size and expertise as a multi-billion dollar firm in the HVAC and refrigeration space to create differentiating characteristics in its refrigeration business to give itself several advantages.

Lennox International operates in several refrigeration markets including food retail, non-food, cold storage, and food service. In a typical gas station convenience store that would qualify as "food retail", a Lennox refrigeration system can run $20K for parts & installation, let alone consistent maintenance and service. For a small-medium sized warehouse, a cold storage system that Lennox installs is typically around $350K along with annual maintenance fees. Where Lennox differentiates itself is it doesn't just install and service its refrigeration units, but it also provides leading technology monitoring systems, flexible order capabilities, and alternative refrigerants tailored to the needs of individual businesses. Sales in the refrigeration segment have been relatively stagnant but not declining at around $720 million in sales at a 13% margin for the past three years; however, the introduction of controllers and innovative monitoring systems was just recently introduced.

Consistency Leads to Free Cash Flow Growth and Dividend Increases

As mentioned in the discussion of Lennox International's core three business segments, revenue has not grown particularly fast, but the growth has been consistent even in times of economic downturns. The year over year upwards trend across Lennox's business segments has led to a substantial improvement in the company's cash flow. In 2014, the company generated approximately $185 million from operating activities. In 2017, that figure was $325 million and estimates from June 2018 place guidance for $495 million from operating activities for 2018. With an increase in business operations to be focused on service and maintenance as well as contracts with local businesses for new installation. The shift to an increased focus on this business model has not only increased revenues but also kept capital expenditures relatively constant. While cash flow from operating activities has ballooned to nearly $500 million for 2018 estimates, the company expects only around $100 million in capex and has spent between $80-100 million the past three years despite growth.

The free cash flow growth has also lent to dividend increases in recent years. Despite being a public company since 1999, it's just since 2012 since the company began increasing its dividend annually. The current yield sits at 1.20% which isn't particularly high, but the payout ratio is only around 25%, leaving the dividend payouts with a substantial amount of room to rise in the coming years should Lennox continue to issue dividend increases.

On a macro scale, Lennox should benefit from overall growth in the North American HVAC market as well as productivity increases from service contracts with national and local vendors and innovations in technology. Some risks to consider are commodity prices as the build costs of new HVAC systems is capital intensive and sensitive to the pricings of raw materials. Other risks to an investment in Lennox are strategic investments not seeing the forecasted benefits. As Lennox continues to scale up it looks to seek new partnerships such as its increased PartsPlus presence and development of new technologies. Heavy investment into these brand developments could cost the company significantly should these strategic moves not pay off.

Lennox International is a buy with no specific time frame. As the company has not had a significant downturn in quite some time, the company is a good addition to a portfolio for consistent gains and is up approximately 15% since last July.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

No comments:

Post a Comment