UMB Bank N A MO cut its stake in Valero Energy Co. (NYSE:VLO) by 14.2% in the 2nd quarter, according to its most recent filing with the Securities and Exchange Commission. The institutional investor owned 19,523 shares of the oil and gas company’s stock after selling 3,238 shares during the quarter. UMB Bank N A MO’s holdings in Valero Energy were worth $2,164,000 at the end of the most recent quarter.

UMB Bank N A MO cut its stake in Valero Energy Co. (NYSE:VLO) by 14.2% in the 2nd quarter, according to its most recent filing with the Securities and Exchange Commission. The institutional investor owned 19,523 shares of the oil and gas company’s stock after selling 3,238 shares during the quarter. UMB Bank N A MO’s holdings in Valero Energy were worth $2,164,000 at the end of the most recent quarter.

A number of other hedge funds and other institutional investors also recently modified their holdings of the business. LSV Asset Management increased its stake in shares of Valero Energy by 0.5% in the 1st quarter. LSV Asset Management now owns 8,934,495 shares of the oil and gas company’s stock worth $828,853,000 after acquiring an additional 41,783 shares in the last quarter. Schwab Charles Investment Management Inc. increased its stake in shares of Valero Energy by 6.6% in the 1st quarter. Schwab Charles Investment Management Inc. now owns 3,710,882 shares of the oil and gas company’s stock worth $344,259,000 after acquiring an additional 228,702 shares in the last quarter. O Shaughnessy Asset Management LLC increased its stake in shares of Valero Energy by 2.9% in the 1st quarter. O Shaughnessy Asset Management LLC now owns 1,862,024 shares of the oil and gas company’s stock worth $172,743,000 after acquiring an additional 52,871 shares in the last quarter. Stifel Financial Corp increased its stake in shares of Valero Energy by 13.9% in the 1st quarter. Stifel Financial Corp now owns 1,366,192 shares of the oil and gas company’s stock worth $126,710,000 after acquiring an additional 166,469 shares in the last quarter. Finally, Robeco Institutional Asset Management B.V. increased its stake in shares of Valero Energy by 70.4% in the 1st quarter. Robeco Institutional Asset Management B.V. now owns 1,020,560 shares of the oil and gas company’s stock worth $94,679,000 after acquiring an additional 421,540 shares in the last quarter. Institutional investors and hedge funds own 77.61% of the company’s stock.

Get Valero Energy alerts:NYSE:VLO opened at $116.78 on Thursday. The company has a debt-to-equity ratio of 0.35, a current ratio of 1.70 and a quick ratio of 1.09. The stock has a market cap of $51.01 billion, a price-to-earnings ratio of 23.54, a PEG ratio of 2.00 and a beta of 0.99. Valero Energy Co. has a fifty-two week low of $64.22 and a fifty-two week high of $126.98.

Valero Energy (NYSE:VLO) last announced its quarterly earnings results on Thursday, July 26th. The oil and gas company reported $2.15 earnings per share (EPS) for the quarter, beating analysts’ consensus estimates of $1.98 by $0.17. The firm had revenue of $31.02 billion for the quarter, compared to the consensus estimate of $26.56 billion. Valero Energy had a net margin of 4.21% and a return on equity of 12.12%. The business’s quarterly revenue was up 39.4% compared to the same quarter last year. During the same quarter last year, the firm posted $1.23 EPS. equities research analysts expect that Valero Energy Co. will post 6.58 earnings per share for the current year.

The business also recently declared a quarterly dividend, which will be paid on Wednesday, September 5th. Stockholders of record on Tuesday, August 7th will be issued a dividend of $0.80 per share. This represents a $3.20 dividend on an annualized basis and a dividend yield of 2.74%. The ex-dividend date is Monday, August 6th. Valero Energy’s payout ratio is presently 64.52%.

Several research analysts recently issued reports on VLO shares. Scotia Howard Weill reiterated a “sector perform” rating on shares of Valero Energy in a research note on Wednesday, April 11th. Howard Weil lowered shares of Valero Energy from a “sector outperform” rating to a “sector perform” rating in a research note on Wednesday, April 11th. Barclays increased their price target on shares of Valero Energy from $122.00 to $135.00 and gave the stock an “overweight” rating in a research note on Friday, April 27th. Morgan Stanley upgraded shares of Valero Energy from an “equal weight” rating to an “overweight” rating and reduced their price objective for the company from $114.99 to $110.00 in a research note on Thursday, May 17th. Finally, Edward Jones upgraded shares of Valero Energy from a “hold” rating to a “buy” rating in a research note on Thursday, May 10th. One research analyst has rated the stock with a sell rating, fourteen have issued a hold rating and twelve have issued a buy rating to the company. The company currently has a consensus rating of “Hold” and a consensus price target of $113.33.

In other news, insider Joseph W. Gorder sold 85,493 shares of the firm’s stock in a transaction dated Monday, May 21st. The shares were sold at an average price of $121.23, for a total transaction of $10,364,316.39. Following the sale, the insider now owns 524,864 shares of the company’s stock, valued at approximately $63,629,262.72. The sale was disclosed in a legal filing with the SEC, which is accessible through this hyperlink. Also, Director Stephen M. Waters sold 1,000 shares of the firm’s stock in a transaction dated Monday, July 30th. The shares were sold at an average price of $116.76, for a total transaction of $116,760.00. The disclosure for this sale can be found here. In the last ninety days, insiders have sold 87,493 shares of company stock worth $10,602,116. Insiders own 0.45% of the company’s stock.

About Valero Energy

Valero Energy Corporation operates as an independent petroleum refining and ethanol producing company. It operates through three segments: Refining, Ethanol, and VLP (Valero Energy Partners LP). The company is involved in oil and gas refining, marketing, and bulk selling activities. It produces conventional and premium gasolines, gasoline meeting the specifications of the California Air Resources Board (CARB), diesel fuels, low-sulfur and ultra-low-sulfur diesel fuels, CARB diesel, other distillates, jet fuels, asphalts, petrochemicals, lubricants, and other refined petroleum products.

Further Reading: Earnings Per Share (EPS)

Genworth MI Canada (TSE:MIC) had its price target boosted by stock analysts at BMO Capital Markets from C$50.00 to C$51.00 in a research note issued to investors on Thursday. BMO Capital Markets’ target price would suggest a potential upside of 13.33% from the company’s previous close.

Genworth MI Canada (TSE:MIC) had its price target boosted by stock analysts at BMO Capital Markets from C$50.00 to C$51.00 in a research note issued to investors on Thursday. BMO Capital Markets’ target price would suggest a potential upside of 13.33% from the company’s previous close. CarGurus Inc (NASDAQ:CARG) VP Sarah Amory Welch sold 7,500 shares of CarGurus stock in a transaction that occurred on Monday, July 16th. The shares were sold at an average price of $37.07, for a total transaction of $278,025.00. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through this link.

CarGurus Inc (NASDAQ:CARG) VP Sarah Amory Welch sold 7,500 shares of CarGurus stock in a transaction that occurred on Monday, July 16th. The shares were sold at an average price of $37.07, for a total transaction of $278,025.00. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through this link.

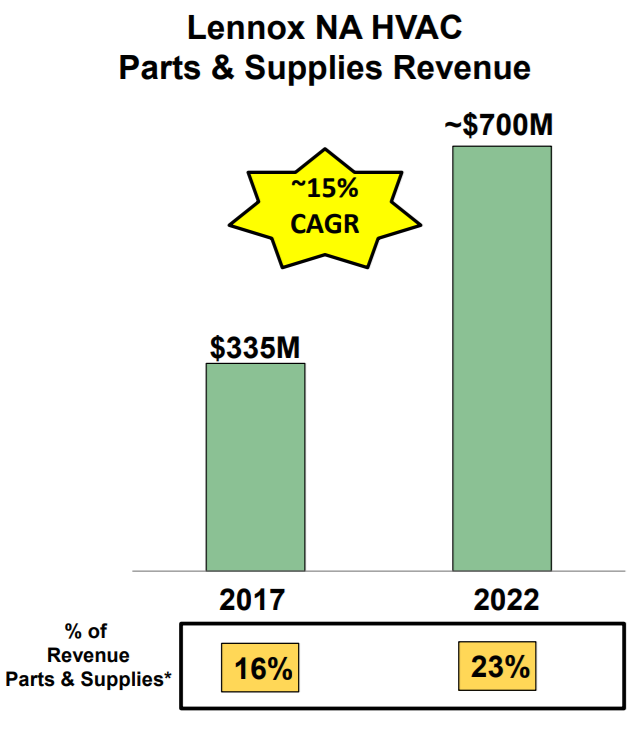

LII data by YCharts

LII data by YCharts

Sophos Group (LON:SOPH) had its target price decreased by Deutsche Bank from GBX 700 ($9.32) to GBX 630 ($8.39) in a note issued to investors on Friday. The brokerage presently has a “buy” rating on the stock. Deutsche Bank’s price objective would suggest a potential upside of 23.29% from the company’s current price.

Sophos Group (LON:SOPH) had its target price decreased by Deutsche Bank from GBX 700 ($9.32) to GBX 630 ($8.39) in a note issued to investors on Friday. The brokerage presently has a “buy” rating on the stock. Deutsche Bank’s price objective would suggest a potential upside of 23.29% from the company’s current price. Tom Gentile

Tom Gentile Wall Street brokerages expect Cytokinetics (NASDAQ:CYTK) to announce sales of $5.57 million for the current fiscal quarter, according to Zacks. Two analysts have provided estimates for Cytokinetics’ earnings, with the highest sales estimate coming in at $6.10 million and the lowest estimate coming in at $5.03 million. Cytokinetics reported sales of $3.05 million during the same quarter last year, which would suggest a positive year over year growth rate of 82.6%. The firm is expected to issue its next earnings report on Wednesday, August 1st.

Wall Street brokerages expect Cytokinetics (NASDAQ:CYTK) to announce sales of $5.57 million for the current fiscal quarter, according to Zacks. Two analysts have provided estimates for Cytokinetics’ earnings, with the highest sales estimate coming in at $6.10 million and the lowest estimate coming in at $5.03 million. Cytokinetics reported sales of $3.05 million during the same quarter last year, which would suggest a positive year over year growth rate of 82.6%. The firm is expected to issue its next earnings report on Wednesday, August 1st. Eternity (CURRENCY:ENT) traded 14.6% lower against the U.S. dollar during the 1 day period ending at 7:00 AM ET on May 28th. Over the last seven days, Eternity has traded 31.6% lower against the U.S. dollar. Eternity has a market capitalization of $156,350.00 and $1,349.00 worth of Eternity was traded on exchanges in the last day. One Eternity coin can currently be bought for approximately $0.0366 or 0.00000506 BTC on exchanges including YoBit, Trade Satoshi and Livecoin.

Eternity (CURRENCY:ENT) traded 14.6% lower against the U.S. dollar during the 1 day period ending at 7:00 AM ET on May 28th. Over the last seven days, Eternity has traded 31.6% lower against the U.S. dollar. Eternity has a market capitalization of $156,350.00 and $1,349.00 worth of Eternity was traded on exchanges in the last day. One Eternity coin can currently be bought for approximately $0.0366 or 0.00000506 BTC on exchanges including YoBit, Trade Satoshi and Livecoin.